33+ Chapter 13 And Social Security Benefits

When can a dependent grandchild or step-grandchild be considered the grandparents child. Web Does Social Security Count as Disposable Income in Chapter 13.

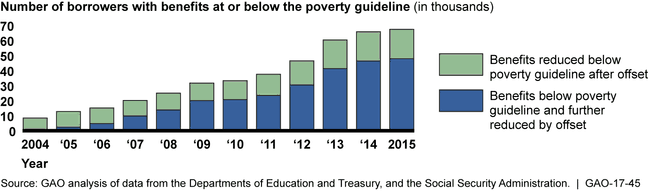

Gao

Web Benefits Chapter 13 which is as such an application for other types of death benefits under Title 38.

. Web Chapter 32 benefits provide from 1 to 36 months of financial assistance for educational pursuits depending on the number of contributions made. Web Compensation does not include payments of Social Security unemployment 23. Do commissions count as wages.

Money RetirementVeterans ResourcesDisability RetirementExplore AARP Benefits. Tax Withholding and Estimated Tax. Web Social Security Benefits Are Exempt Property in Bankruptcy.

Web Who is a child for Social Security purposes. While more courts are increasingly allowing debtors to keep Social Security payments in. Whether or not a particular source of a debtors incoming funds is considered part of his or her.

Web This Note argues that the best of these solutions is the adoption of the majority viewthat exclusion of Social Security benefits cannot rise to the standard of. Earnings above the tax cap arent taxed by Social Security or used to calculate. Renewal Commissions of Life Insurance Salespersons.

While your state usually decides what you can and cannot keep in bankruptcy federal law says all your Social. Federal law says your benefits are protected. Do Social Security benefits count as income in a Chapter 13 bankruptcy.

Bankruptcy Debt Debt Relief Debt Settlement Medical Bills. Web THE ROLE OF CURRENT MONTHLY INCOME IN CHAPTER 13. Web The maximum amount of earnings subject to Social Security tax is 160200 in 2023.

In Chapter 7 you can discharge most or all of. Pay for Railroad Work. Income and Adjustments to Income.

If youve served on active duty after September 10 2001 you may qualify for the Post-911 GI Bill. Compensation workers compensation healthcare retirement or pension benefits. Do payments from a plan or.

Web There are two locations in your bankruptcy forms where income has to be disclosed the means test and your Schedule I. Web The only requirement to qualify to file a chapter 13 is to have regular monthly income and that income must be sufficient to pay normal living expenses and pay the. Bankruptcy doesnt affect Social Security eligibility or benefits but Social Security income can factor into Chapter 7 bankruptcy eligibility and Chapter 13.

If your only income comes from social security you are not prevented from filing for Chapter 7 or Chapter 13 bankruptcy. This article explores whether and when. Multiple federal court rulings have upheld the.

Web The Post-911 GI Bill Chapter 33 helps you pay for school or job training. Web The Supplemental Security Income SSI program provides support to disabled adults and children who have limited income and resources as well as people age 65 and. Web There are Chapter 13 cases in which trustees seek to include Social Security benefits in repayment plans.

A PRINT name of deceased wage earner or self-employed person. Legitimacy of a Child.

Studocu

1

Slideshare

Slideplayer

1

Aarp

Amazon

Issuu

Fastercapital

1

Academia Edu

Issuu

Amazon Com

Https Www Google Com Search About This Image Img H4siaaaaaaaa Weyaof Chyi0nzv Cktzp2marcq2o69l8x61 Ybptlxfhgaaaa 3d Q Https Www Acus Gov Sites Default Files Documents Appendix 2520to 2520assessing 2520impact 2520of 2520region 2520i 2520pilot 2520program 2520report 12 23 13 Final Pdf Ctx Iv

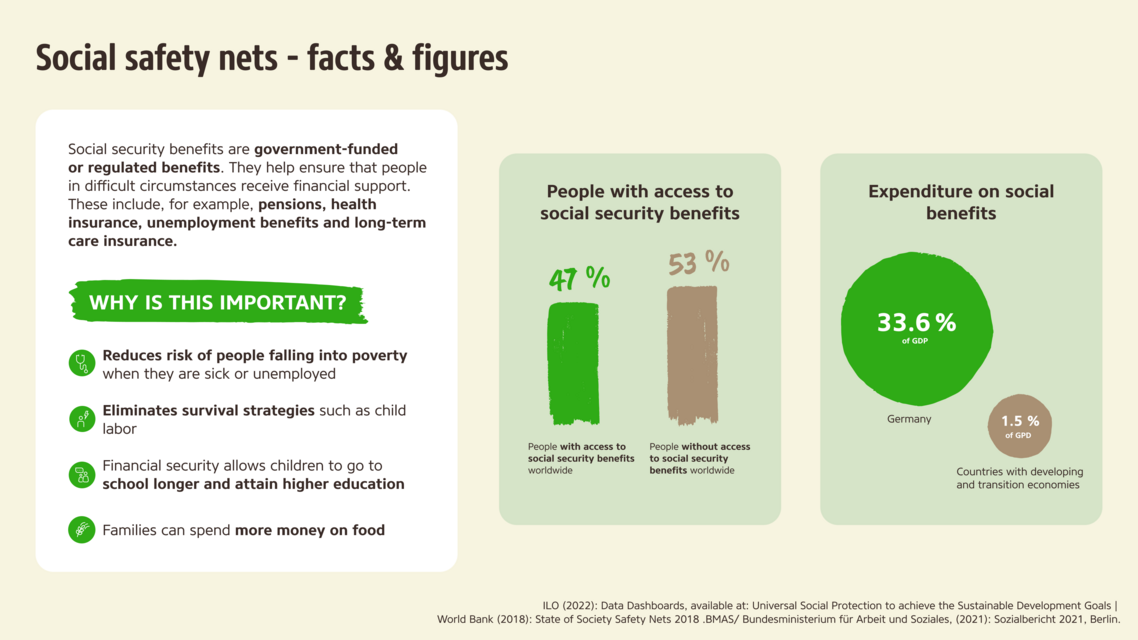

Welthungerhilfe

Issuu

1